Unknown Facts About Ach Processing

Table of Contents6 Simple Techniques For Ach ProcessingAch Processing for BeginnersThe Only Guide to Ach ProcessingSee This Report about Ach ProcessingGetting My Ach Processing To Work

Direct payments can be used by people, businesses, and also various other organizations to send money. If you're paying a bill online with your bank account, that's an ACH direct settlement.The person or entity obtaining the money registers it in their bank account as an ACH credit rating. Making use of ACH transfers to pay expenses or make person-to-person payments offers numerous advantages, beginning with ease.

In enhancement, an ACH payment can be extra protected than other types of settlement. Sending out and getting ACH repayments is usually quick.

What Does Ach Processing Do?

Cord transfers are recognized for their rate and also are often made use of for same-day service, but they can in some cases take longer to complete., for circumstances, it might take a number of service days for the money to relocate from one account to another, then an additional few days for the transfer to clear.

There are some possible downsides to remember when using them to relocate money from one bank to one more, send out payments, or pay costs. Numerous financial institutions impose limitations on just how much money you can send out through an ACH transfer. There might be per-transaction limits, everyday restrictions, and month-to-month or weekly limitations.

Ach Processing Things To Know Before You Buy

Or one type of ACH deal may be endless yet an additional may not. Banks can likewise impose limitations on transfer locations. They might prohibit global transfers. Interest-bearing accounts are regulated by Federal Get Guideline D, which might limit specific kinds of withdrawals/transfers to six monthly. If you look at that restriction with numerous ACH transfers from cost savings to one more bank, you could be struck with an excess withdrawal fine.

When you choose to send out an ACH transfer, the moment structure issues. That's since not every financial institution sends them for financial institution handling at the very same time. There might be a cutoff time by which you need to get your More Help transfer in to have it processed for the next service day.

ACH takes a standard of one to three business days to complete and is taken into consideration slow-moving in the period of fintech and instant payments. Same-Day ACH processing is growing in order to fix the slow-moving solution of the basic ACH system. Same-Day ACH quantity climbed by 73. 9% in 2021 from 2020, with a total amount of 603 million settlements made.

The Of Ach Processing

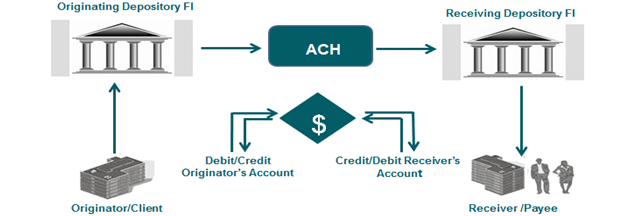

An ACH bank transfer is a you can look here digital settlement made between banks for repayment objectives. ACH financial institution transfers are used for numerous functions, such as straight deposits of paychecks, financial obligations for normal payments, and cash transfers.

Both wire transfers and ACH transactions are used to facilitate the movement of cash. Wire transfers normally happen on the exact same day and set you back even more. ACH transfers usually take longer to finish; nevertheless, same-day ACH transfers are becoming more common - ach processing. ACH is additionally for residential transfers whereas global transfers are done by cord transfers.

7 Simple Techniques For Ach Processing

In either case, make sure you comprehend your bank's plans for ACH straight deposits and also direct repayments. Additionally, be cautious for ACH transfer rip-offs. A typical scam, as an example, entails someone sending you an e-mail informing you that you're owed cash, and also all you require to do to receive it is provide your checking account number as well as directing number.

Editor's note: This short article was very first released April 29, 2020 and also last upgraded January 13, 2022 ACH represents Automated Cleaning Home, an U.S. economic network utilized for digital repayments and also money transfers. Recognized as "direct payments," ACH repayments are a means to move money from one bank account to an additional without using paper checks, credit report card networks, wire transfers, or cash.

As a consumer, it's his explanation likely you're currently acquainted with ACH payments, also though you may not be aware of the lingo. If you pay your bills online (instead of creating a check or going into a credit scores card number) or receive direct deposit from your employer, the ACH network is possibly at work.